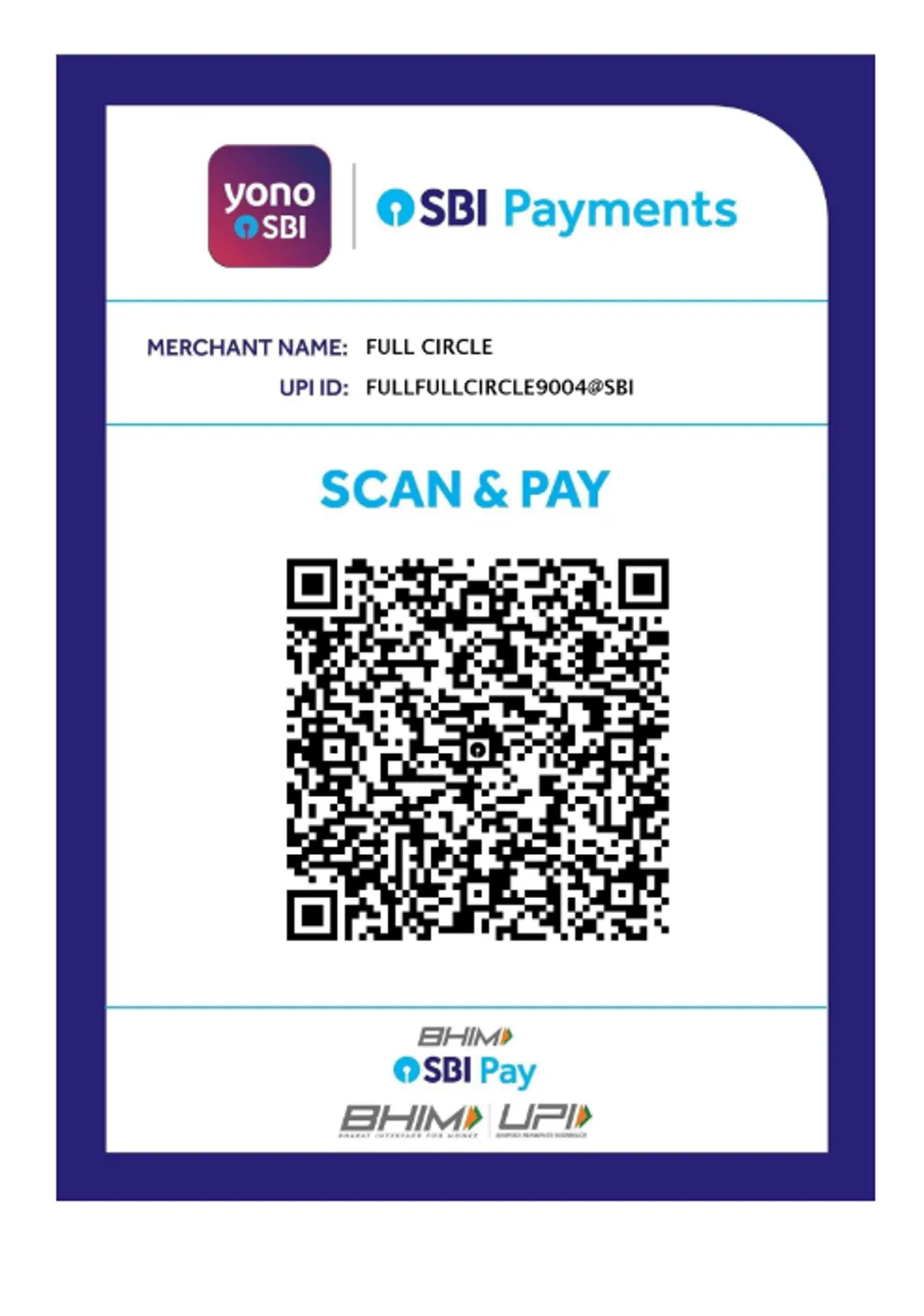

QR Code For Payments

Donations

FULL CIRCLE is a young NGO and will need all the support it can get. You too can make a difference in the lives of these fellows. Let’s together give her wings and help them fly. Join the Good Cause-Join FULL CIRCLE. All donations are eligible for 50% exemption under 80G

All it takes is

Rs 12,000 To support a talented fellow for one year at the School Level

Rs 15,000 To support a talented fellow for one year at the College level

You could support one or more girls. We support fellows all the way to their graduation or vocational courses.

Our Bankers: (Domestic donations only)

Bank: State Bank of India

Account Name: Full Circle

Account No: 40317889004

IFSC: SBIN0063839

As per latest rules of Income Tax Department, Govt. of India, following details are required in respect of all donors, for claiming Income Tax rebate in the Income Tax returns.

1. Name of Donor

2. Address of Donor

3. Nature of Donation – Corpus / Welfare / Specific Reason

4. PAN No. or Aadhar card Number

On receipt of above details, donors will be eligible for Income tax rebate for which we will issue Form 10 BE to donors.

In view of the above all donors who have donated through NEFT, Cheque, Google pay or cash are requested to send above mentioned details for the year 2023-2024 to following WhatsApp Number: 9810139447